Carbon Tax.

The ultimate Alberta mood-ruiner.

It’s like telling a kid there’s no Santa, but for adults, and with taxes.

Karl Hrens is a self-proclaimed white, blue-collar, oilpatch-working truck driver who, not surprisingly, has much to say about the carbon tax.

“I get money back, farmers and fisheries are exempt, there’s a scaling system for major industries. It’s just so good it just wrecks my whole worldview. Uhg,” he said in one of the many videos he’s made on the topic.

Not quite what you were expecting, eh?

Deep Research From An Average Trucker

Hrens may be an average trucker, but he’s spent well above the average time researching these tax policies.

“That’s a problem,” he joked “because everything I hate (policymakers) have thought about.”

After reading what he describes as “a Political Science Degree’s worth of legislation,” he concludes that despite upcoming tax increases, the carbon tax will not cost him a thing.

In fact, as someone with an average income, he says he’ll be making money from the carbon tax refunds.

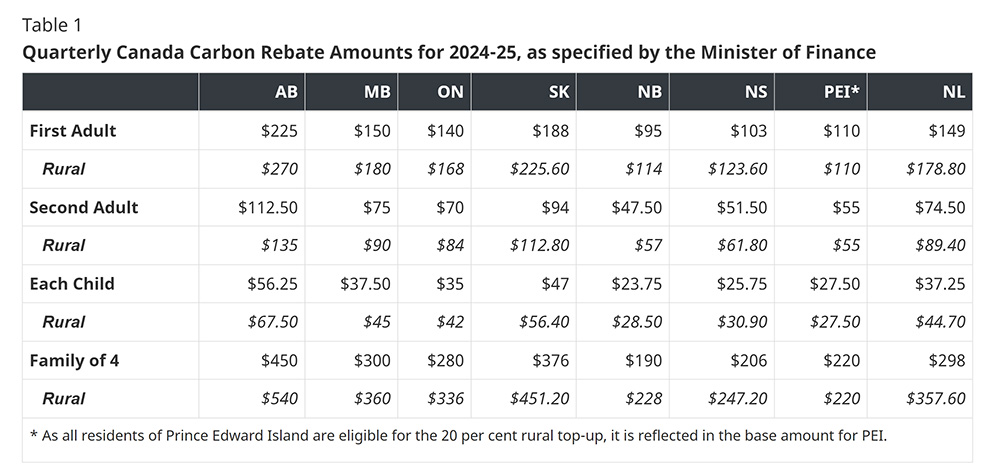

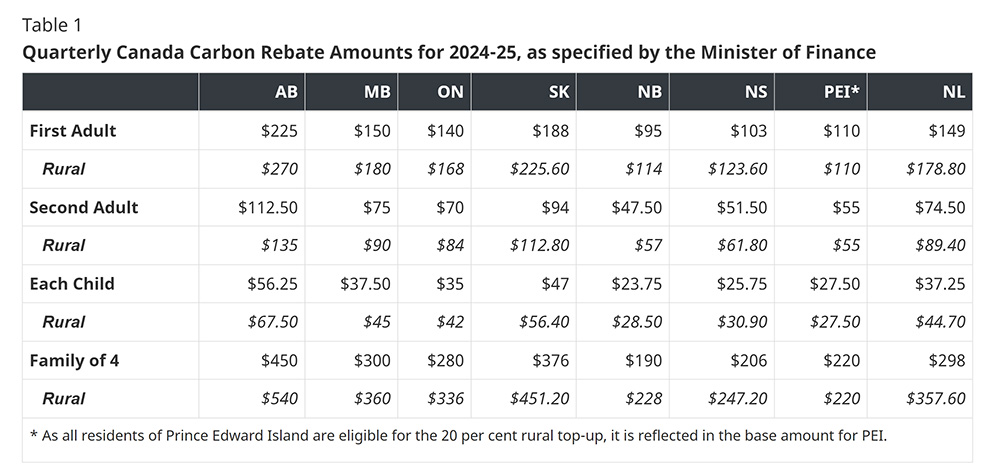

“Even with the new increase coming in, I only pay about an extra 14 cents a litre at the gas pump, which (filling up once a week) for me personally, works out to an extra $290 a year in expenses. But federally, I’m looking at them giving me an extra fifteen hundred back. I’m actually making money.”

In 2021, the tax gave all Canadians who paid the national levy an average rebate of $804 — about $250 more than they paid.

In Alberta, those rebates total about $1800 yearly for a family of four.

However, many people don’t even know about the rebates – Hrens didn’t until he looked into it.

“As citizens, we don’t pay more. The people who are paying for these taxes are the major corporations, and then the money is going to the provincial governments. Not Trudeau,” Hrens said.

Leave My Wallet Alone!

Hrens argues that blue-collar workers are against the carbon tax because they feel the government is taking money directly from their pockets.

“We have this emotional response of: ‘I don’t want to be taxed. I’m busting my ass, I’m struggling to feed my family, I’m struggling to pay rent. I don’t want more taxes,'” he said.

In today’s climate, it’s a fair and justified response and is one of the reasons why Hrens started making his comedic and informational videos.

“I still have this voice in the back of my head that says if I’m struggling to pay bills, it is because I’m not working hard enough — I need to do more as an individual,” he said. “But the problem isn’t my work ethic. The problem is the society we’ve developed puts people like me at a disadvantage.

He points out, for example, the billionaire businessman who chairs Loblaws, the largest grocery chain in Canada.

“Galen Weston. He spikes prices to increase his profit while the average man fights over imaginary issues,” said Hren.

The carbon tax may add a couple of cents to some of the most processed and manufactured food products.

However, Weston has been notoriously spiking his prices in line with carbon tax announcements – giving the average Joe a scapegoat to blame the obscene increases on.

At the same time, the company simply pockets the extra profit.

The Little Guy Benefits

Hren’s main point is that the average person will benefit from this tax, while it holds accountable the large industries that aren’t prioritizing the well-being of average people.

“The point being that these major corporations make huge amounts of pollution, they pay for it, and the provinces take that money to reinvest in things like healthcare, education, better roadways.”

With almost 70K views and a lot of positive comments, this trucker is doing a better job explaining the carbon tax in an 80-second video than the entire federal government has done with all their high-paid communication teams.

Hrens’ efforts on social media exemplify the power of grassroots advocacy in fostering informed dialogue.

It’s much needed.

If you’re interested in seeing what Hren has to say firsthand, he’s got a whole account dedicated to giving his simple explainers, which he says people can take or leave as they please.

As he’s captioned his account @tiredandfrozen (we can relate),

🚫 Reporter 🚫 Activist 🚫 Comedian ✅️ Fat guy with a phone

At this point, this is one fat, blue-collar guy with a phone that we’ll hear out.

@tiredandfrozen #greenscreen #carbontax #axethetax #conservative #liberal #democrat #republican #government #truestory #education #educational #learn #canada #yeg #yyc #environment #climatechange #science #politics

♬ original sound – TiredandFrozen